Holiday activity of DIY stores – analysis

Traffic and reach: strong season, peak in July

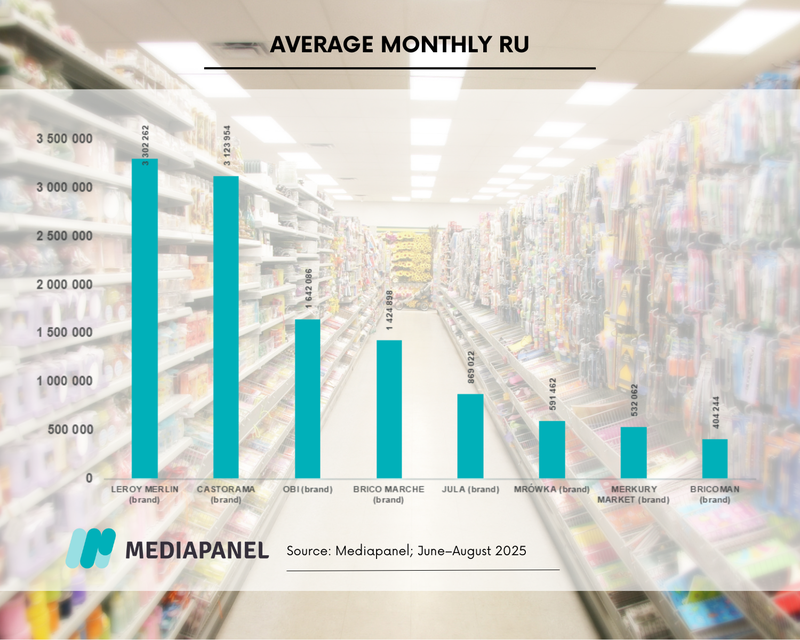

During the summer holidays, the websites and apps of the eight analysed chains (Bricomarché, Bricoman, Castorama, Jula, Leroy Merlin, Merkury Market, Mrówka, OBI) were visited by an average of 7.35 million real users per month, with a noticeable peak in July – approx. 7.5 million RU. The leaders in terms of reach were Leroy Merlin (3.3 million RU) and Castorama (3.1 million RU), while OBI (1.6 million) and Bricomarché (1.4 million) also exceeded 1 million RU. Other brands, including Jula, Mrówka, Merkury Market and Bricoman, generated traffic below one million.

Engagement and loyalty: brief contact per brand, low duplication

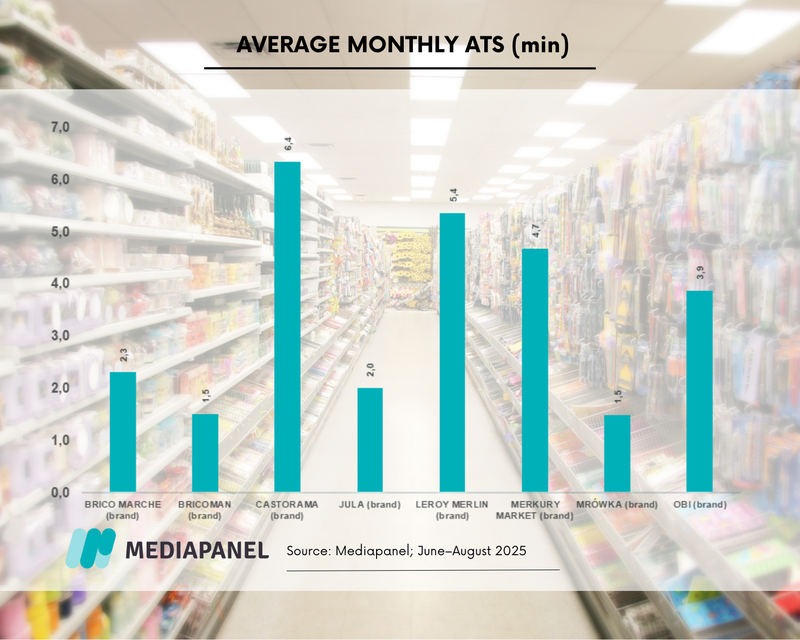

The average user in the entire category spent approximately 7.2 minutes per month. In terms of per brand, the highest average time was recorded by Castorama (6.4 minutes) and Leroy Merlin (5.4 minutes), while Merkury Market took third place (4.7 minutes). This indicates that in this industry, contact within a single network is relatively short and task-oriented – users visit the site to find specific information (product, availability, price, offer) and then leave.

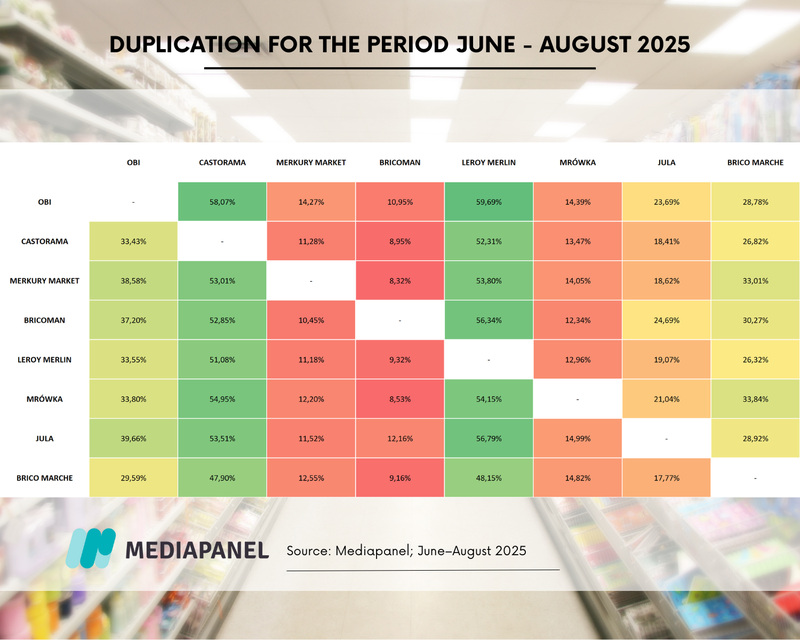

Duplication between brands is low, suggesting that users are loyal to their favourite chain. The highest level of overlap was recorded between OBI and Leroy Merlin – over 59% of all OBI visitors also visited Leroy Merlin. For reach planning, this means that combining selected brands can build incremental reach even with a seemingly similar audience.

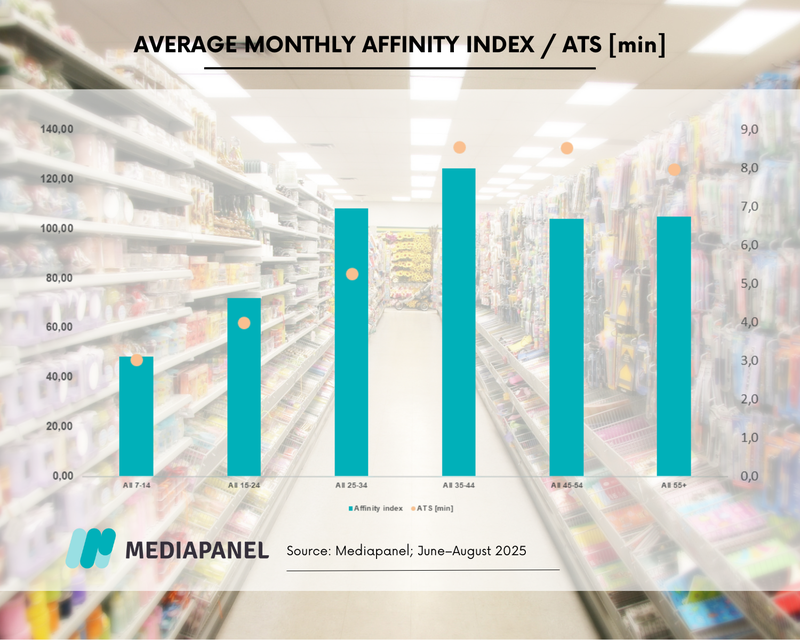

Demographically, websites of shops in this industry are best suited to Internet users aged 35–44 (Affinity Index of 124), while people aged 35–44 and 45–54 spend the most time on them (an average of 8.5 minutes per month in the period from June to August).

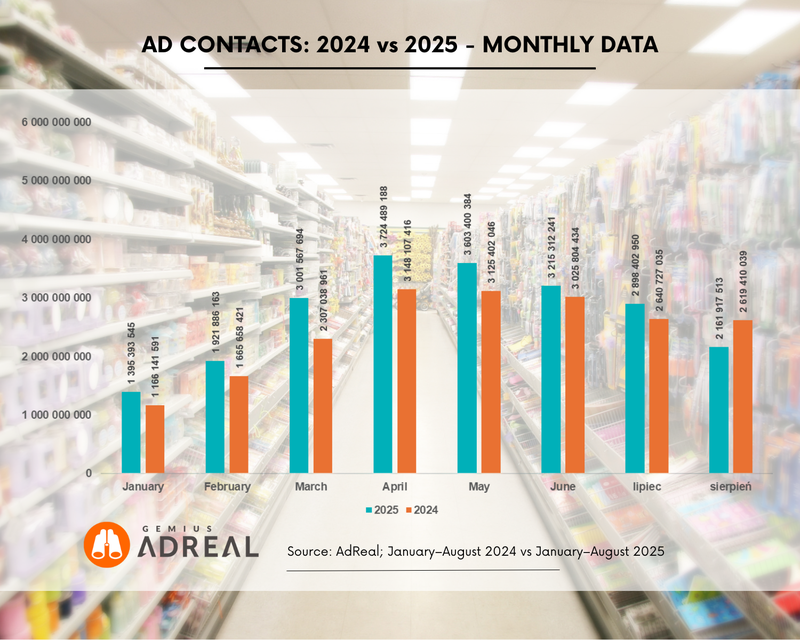

Advertising activity: more contacts than a year ago, peak before the season

On an annual basis (2025 vs 2024), the analysed brands generated more ad contacts, maintaining the upward trend from January and peaking in April–May, just before the summer holidays.

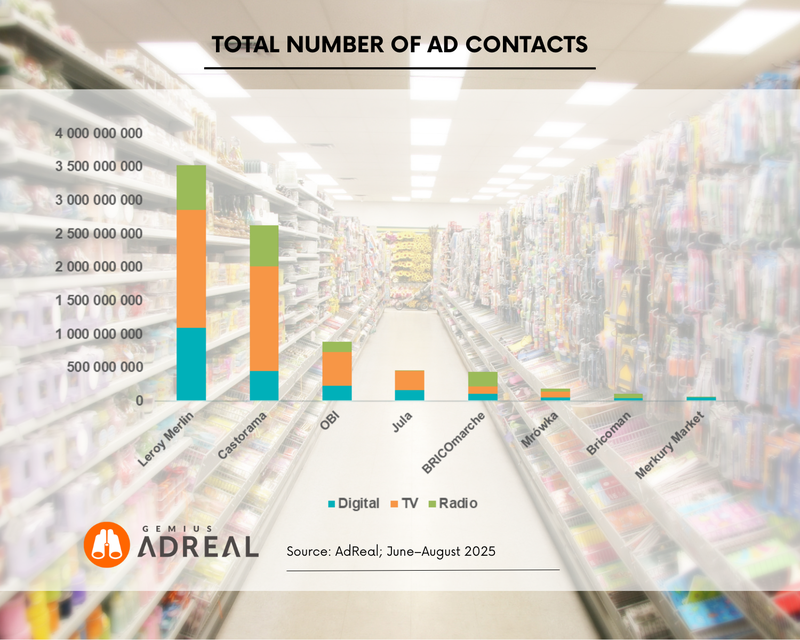

During the season itself (July-August), Leroy Merlin generated approximately 3.5 billion ad contacts, and Castorama approximately 2.6 billion, clearly distancing themselves from the rest of the field. Most brands used a full mix of TV/radio/internet, with the exception of Bricoman and Merkury Market, which did not run campaigns on the monitored TV stations.

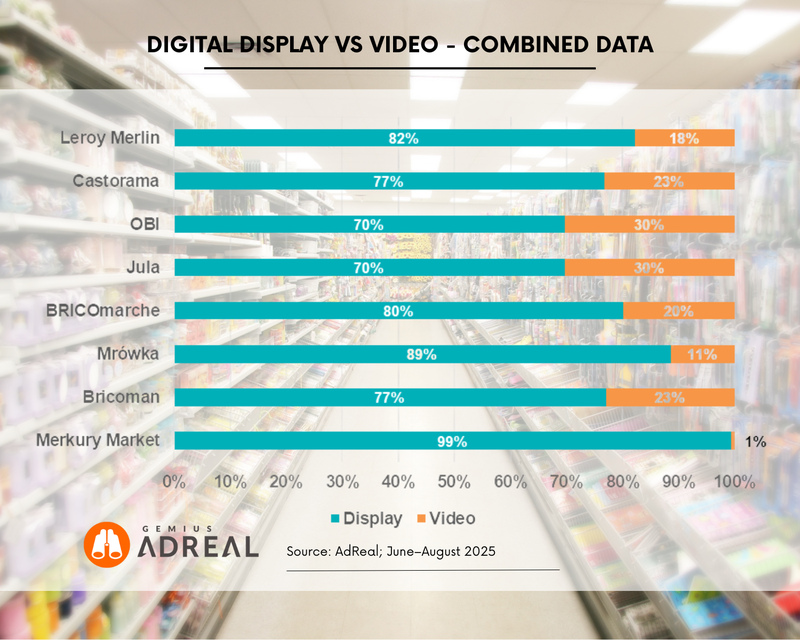

Digital: display dominance and emphasis on the Google ecosystem

The balance of power among brands on the internet corresponds to that of the entire market, with Merkury Market being slightly more active in the digital sphere. In terms of advertising formats, display dominates, with its share ranging from ~70% to almost 100% depending on the brand. For most brands operating online, we observe a similar ratio of display to video formats (Leroy Merlin 82%/18% display/video; Castorama 77%/23%; OBI 70%/30).

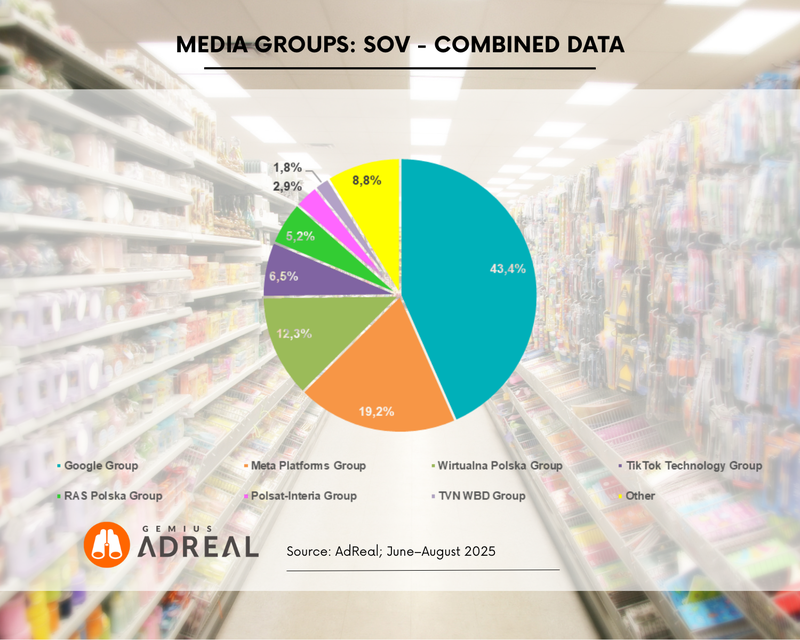

In terms of channels, the most digital contacts were generated in the Google ecosystem – 43.4% SoV. The next places were taken by: Meta Platforms – 19.2%, Wirtualna Polska – 12.3%, TikTok – 6.5%, RAS Polska – 5.2%, Polsat-Interia – 2.9%, TVN WBD – 1.8% and other channels – a total of 8.8%.

Google remains the foundation of online plans, while Meta and premium publishers are responsible for expanding reach and controlling context quality. TikTok is no longer a niche player – its ~6.5% share during the holidays is a real contribution to reaching mainly younger users.