Financial apps during the holidays: stable habits, realistic reach and a few surprises

The holiday season does not disrupt mobile finances

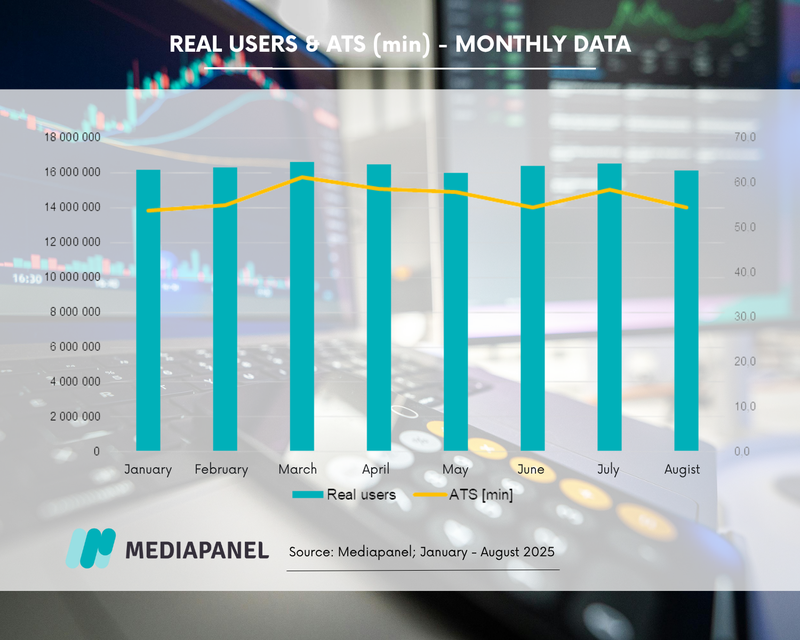

Contrary to the hypothesis that greater mobility in the summer should boost the use of applications (e.g. payments, currency conversions, card limits when travelling), the 2025 holiday season proved to be neutral in this respect. Both the number of users (RU) and the average time spent (ATS) remained stable.

During the holiday season (June–August 2025), an average of 16.3 million real users used these applications each month, spending an average of 55.8 minutes per person. In other words, having a bank in your pocket is a habit that works just as well in the office, on the beach, or on a mountain trail.

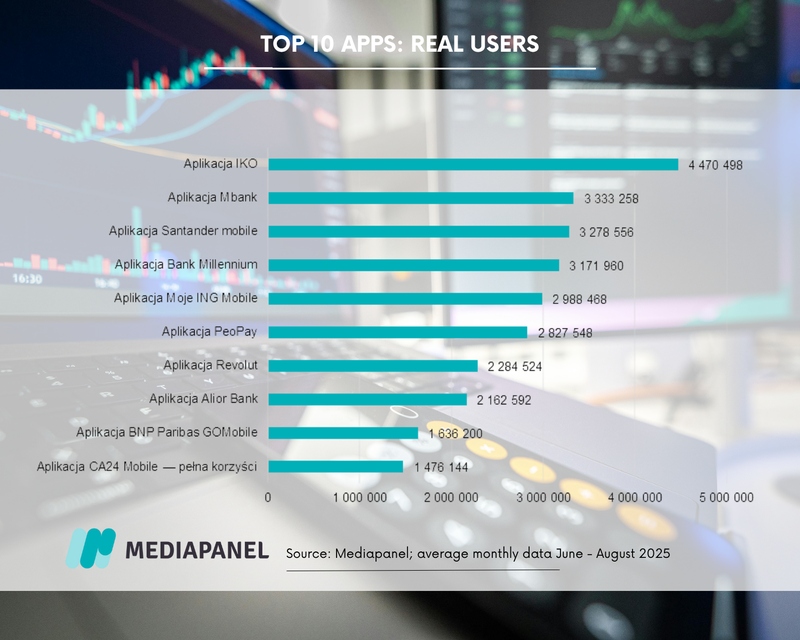

Who rules the TOP 10 in the ‘financial services’ category?

The TOP 10 ranking of applications in the ‘financial services’ category is dominated by banking applications. The leader in terms of reach in the analysed period was the IKO app, with an average monthly number of real users of 4.5 million and an average monthly time per user of 33.7 minutes. It was followed by the mBank (3.3 million RU) and Santander mobile (3.3 million RU) apps. The top 10 was rounded off by the CA24 Mobile application, with 1.5 million RU.

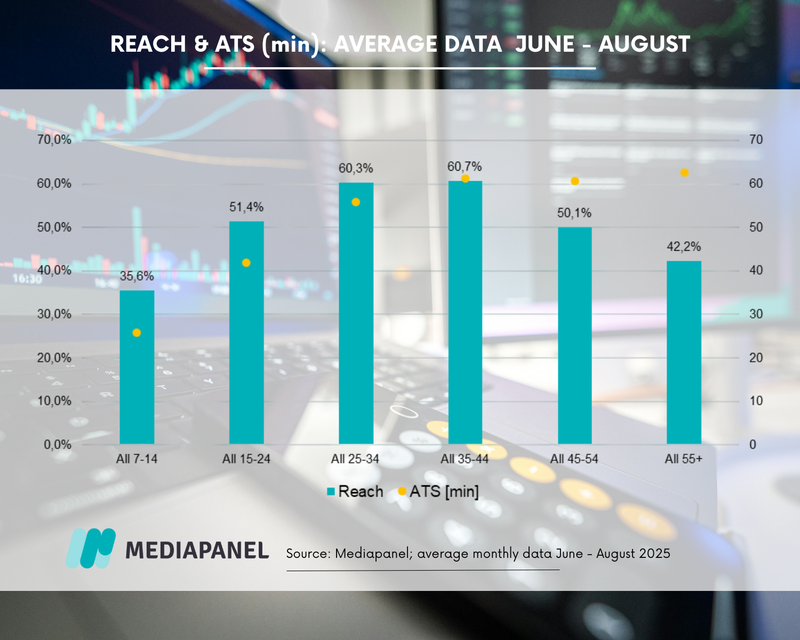

Demographics: most users aged 25–44, longest usage by users aged 55+

The highest monthly reach was achieved in the 25–34 and 35–44 age groups – in both cases, over 60% of the population in a given age cohort used financial applications during the summer holidays.

These are key age groups for the financial industry: professionally active users who are making important financial decisions (loans, investments, family purchases) and are familiar with mobile banking and cashless payments.

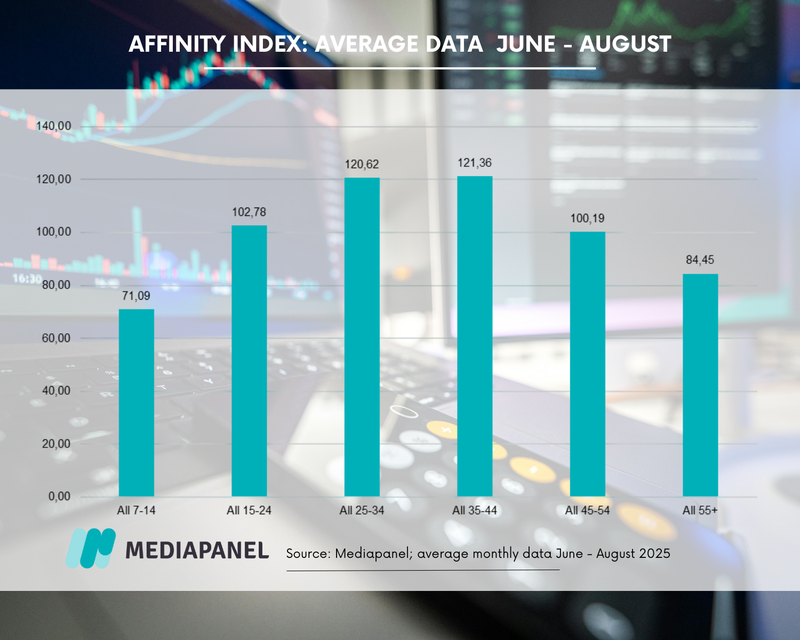

This is confirmed by the average monthly Affinity Index. In the 25–34 and 35–44 age groups, it averages around 120, which means that users in this age group are overrepresented in relation to the total population. In other words, users in these cohorts are significantly more likely to use financial apps than the average.

The longest average monthly ATS was recorded in the 55+ age group, where it amounted to approximately 62 minutes. This indicates that older users, although they use financial applications relatively less often, may perform more steps during a single session (e.g., thoroughly review their history, verify settings, use help), or simply navigate more slowly.

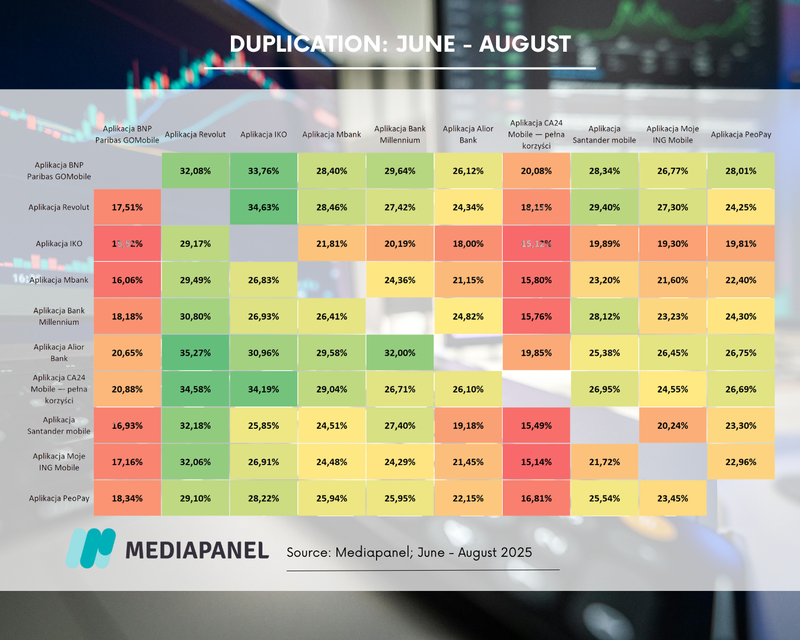

Revolut with the highest duplication rate

Revolut stands out in the duplication analysis (user base overlap). It is the app that most often overlaps with users of other solutions from the TOP 10 financial services apps.

For most banking applications, the share of users who also use Revolut exceeds 30%. The record is held by Alior Bank, where this duplication amounted to over 35% in June–August.

Summary

The 2025 summer holidays did not change habits in the use of financial applications. Reach and usage times remained stable, with the TOP 10 dominated by apps from the largest banks, led by IKO. Stable demand for mobile services is good news for the industry. It means that the key to growth lies not in seasonal ‘spikes’ but in the systematic improvement of services so that the app is the first, natural choice for everyday use and when travelling.