Advertising market in Poland - October 2024

The data presented in this article comes from gemiusAdReal, a cross-media advertising market study. The study analysed advertising creatives broadcast on the internet, television and radio in October 2024.

Internet advertising market

In October 2024 we recorded 87.16 billion online ad impressions and the average number of ad contacts per user was 3071 contacts. Online advertising activities reached a total of 86.87% of the Polish population aged 7 to 75.

The average time spent with a creative was 9.23 seconds (10 seconds for a display creative and 7.06 seconds for a video creative).

The average viewability of digital creatives in October (calculated according to the IAB definition) was 45.41%. Video creatives achieved a higher viewability rate, with 55.51% of impressions being visible in the browser window. This compares with 42.89% for display creatives.

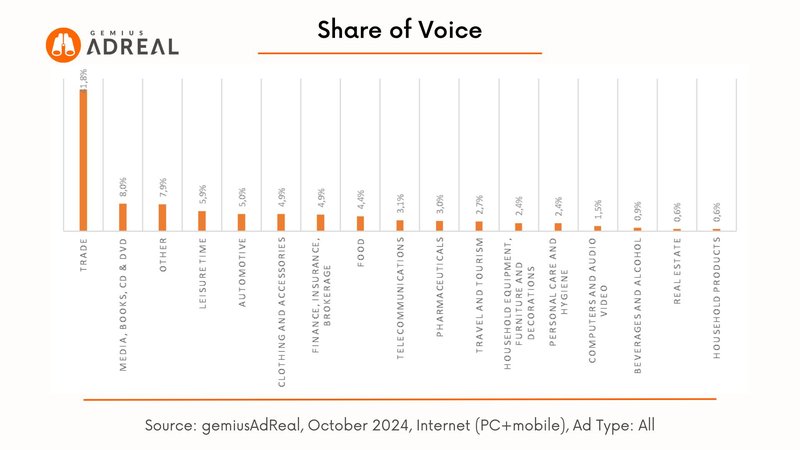

The most active sector in terms of online ad contacts was 'Trade' (36.41 billion), which accounted for 41.8% of all online ad contacts in October. The average contact time for this sector was 9.74 seconds and the creative viewability was 48.20%.

Next on the podium were 'Media, books, CD & DVD' (7 billion ad contacts and SoV of 8%) and 'Leisure' (5.15 billion ad contacts and SoV of 5.9%).

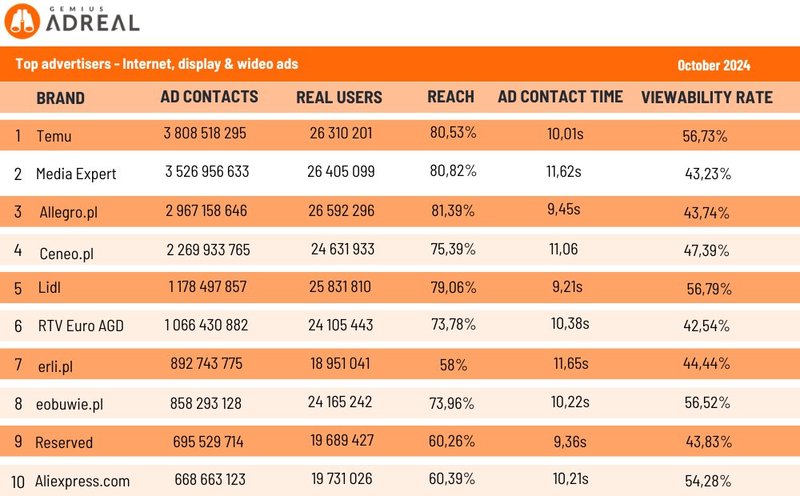

Top online advertisers

The most active digital advertiser in October 2024 was the Temu brand, which generated 3.81 billion online ad contacts and reached 80.53% of Poles aged 7 to 75. In second place was Media Expert with 3.53 billion ad contacts and 80.82% reach. The third place on the podium belonged to Allegro.pl (2.97 billion ad contacts and 81.39% reach).

The top 10 brands were rounded off by Aliexpress with 0.69 billion ad contacts.

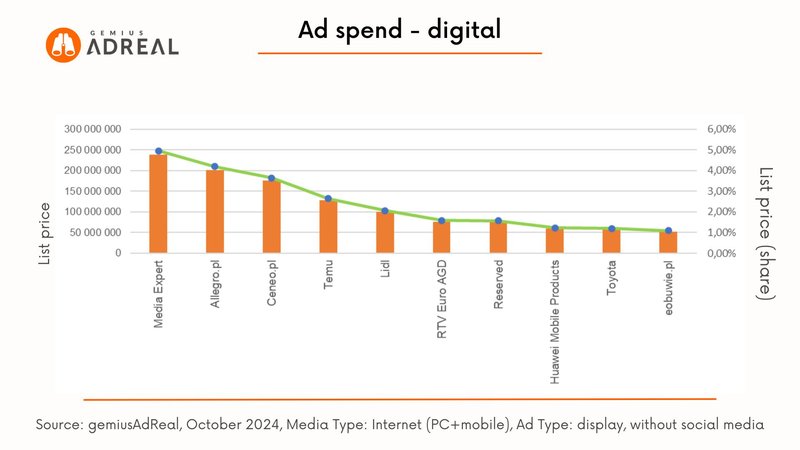

Online ad spend

The top brand in terms of display ad spend in October 2024 was Media Expert, with a 4.77% share of all brands. Allegro was in second place with a 4.04% share, while Ceneo rounded off the podium with a 3.51% share.

It should be remembered that the online ad spend figures represent values estimated from publishers' price lists, where all activities were calculated at a CPM (cost per mile) rate. They are calculated for display activity, on PC and Mobile platforms, excluding video and social media/search engines.

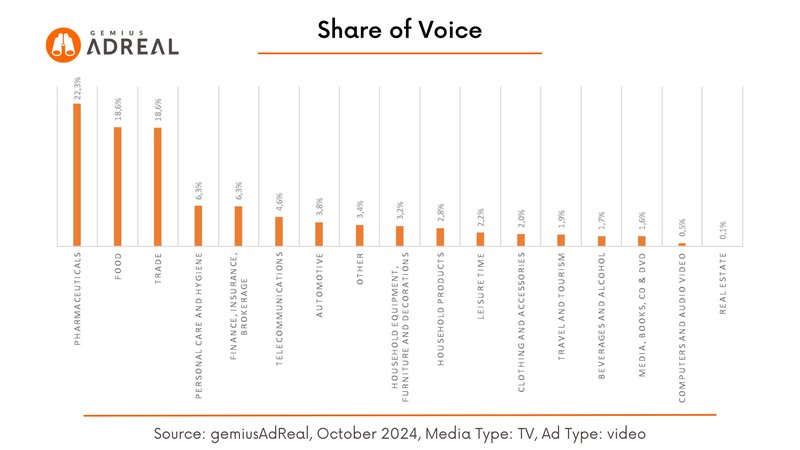

TV advertising market

In October, the "Pharmaceuticals’' sector was the most active in terms of television advertising. It generated 14.4 billion ad contacts, reaching 91.50% of the population aged 7 to 75. The share of voice in all ad contacts in October for this sector was 22.3%, while the average contact time for an ad in a traditional receiver was 20.89 seconds. In second place was "Food" (12 billion ad contacts, SoV of 18.6% and reach of 91.13%), followed by "Trade" (11.98 billion ad contacts, SoV of 18.6% and reach of 91.47%).

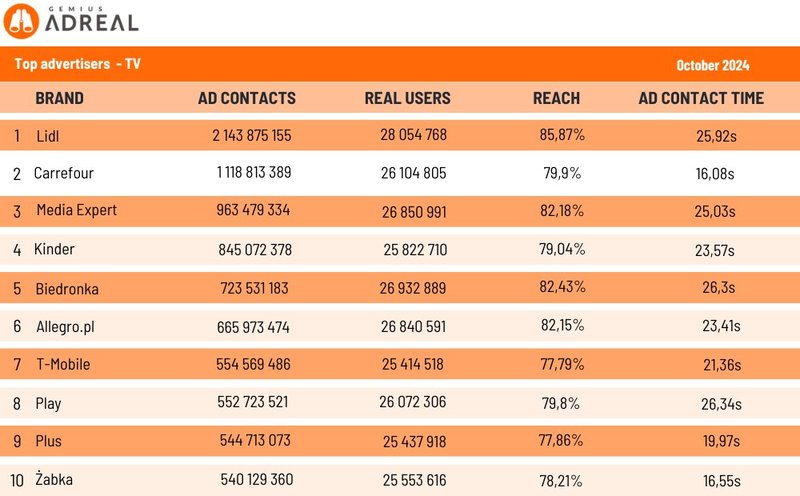

Top TV advertisers

The most active TV advertiser in October was the Lidl brand. It generated 2.14 billion ad contacts and reached 85.87% of Poles aged 7 to 75. Carrefour came in second (1.12 billion ad contacts and 79.90% reach), while Media Expert came in third (0.96 billion contacts and 82.18% reach). Żabka was ranked 10th with 0.54 billion ad contacts and 78.21% reach in the 7-75 age group.

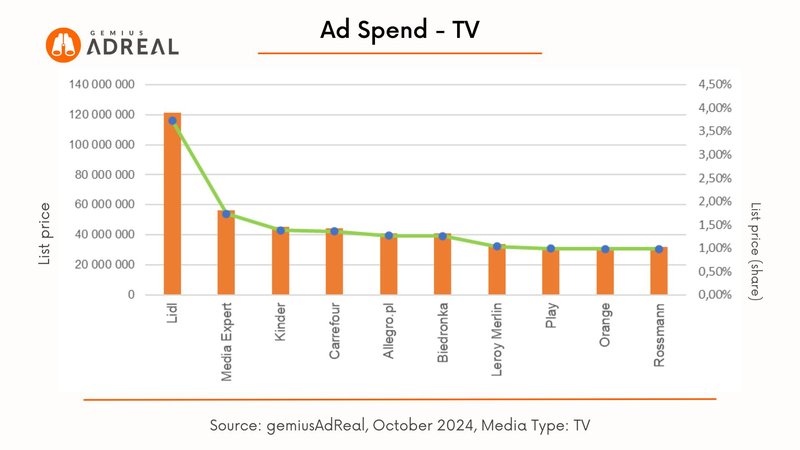

TV ad spend

In terms of estimated TV ad spend, the Lidl brand was in first place with a share of 3.90%, followed by Media Expert with a share of 1.81%. Kinder came third with a share of 1.45%.

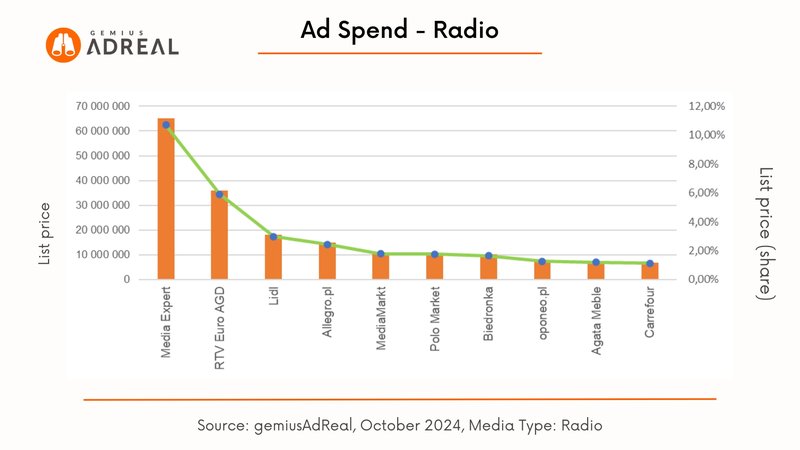

Radio advertising market

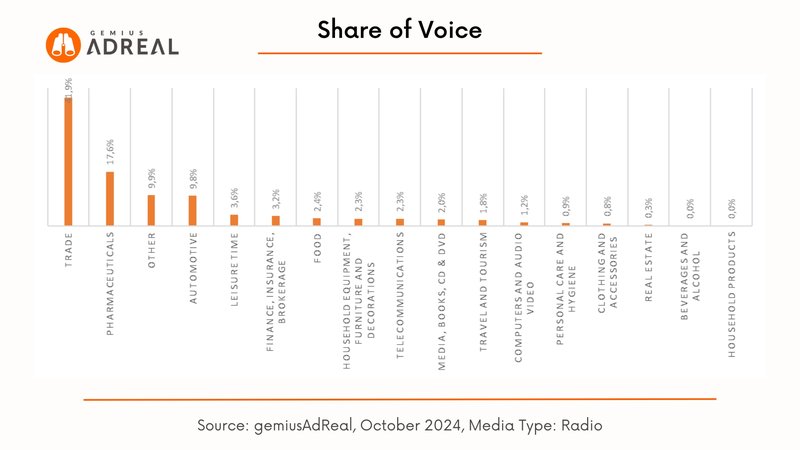

In radio, the sector with the highest number of ad contacts in October was "Trade" (12.18 billion). In second and third place were '"Pharmaceuticals" (5.12 billion contacts) and "Automotive" (2.86 billion contacts).

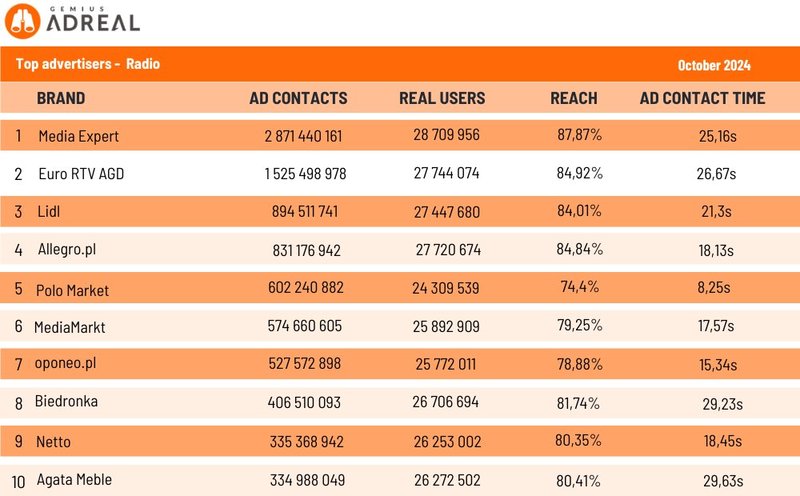

The most active radio advertiser in October was again the Media Expert brand - it generated 2.87 billion ad contacts, reaching 87.87% of Poles aged 7 to 75. In second place was RTV Euro AGD (1.53 billion contacts, 84.92% reach) and in third place Lidl (0.89 billion contacts, 84.01% reach). Agata Meble (0.33 billion contacts and 80.41% reach) rounded off the top 10.

Radio ad spend

The brand with the highest share of radio ad spend in October was Media Expert (11.61%). It was followed by RTV Euro AGD (6.42%) and Lidl (2.24%).